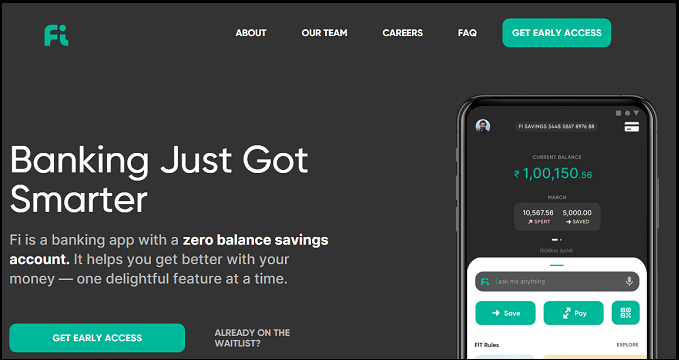

Are you looking for a FI Money Review? Fi. Money is a platform for online banking that not only helps you save money it even assists in growing it and organizing your funds. Currently, features by FI are available for working professionals and people working on a specific salary.

The financial app includes in-built savings account with the option of zero balance savings. Moreover, the auto-bot allows the user to make specific rules, which can also be modified to automate processes for saving, paying, and reminding.

Also, in partnership with Federal Bank, Fi Money adheres to all security standards according to the RBI regulations, and the funds/money is insured for up to ₹5 lakh. From numerous features offered by the platform to the fee structure and method for signing up, there are multiple steps needed to start saving your money in a smart online bank account.

That’s an all-in nutshell, read more and get a firm understanding of the things Fi offers and how it can assist in saving money.

FI.Money Overview # FI Money Detailed Review!

Fi is a recently established company offering a range of services, including p2p payments to fund transfers and bill payments.

Fi is like a personnel assistant that provides multiple features that make banking hassle-free. The ability to withdraw from any ATM, clarity in fees, and a user-friendly dashboard makes Fi a great online baking platform.

Moreover, there are cash-backs and rewards which can be redeemed on selected outlets. Moreover, users can save up to 5.1% interest on terms with the flexible and smart deposit options. Also, personal insights allow you to make better money decisions and much more.

Fi strives to maintain high standards of confidentiality, safety, and security when using the funds or data. The data collected enables Fi to make a better user experience that grants a secure, swift and convenient experience on the platform. Apart from personalizing and enhancing user experience, the platform also uses data to prevent any misuse.

Features of FI Money Bank

-

Insights

For a better understanding of online spending, insights provided by Fi lets the user make smart decisions, especially on E-commerce and food delivery websites.

The insight will reveal the number of times the user purchased different things from an E-commerce platform such as amazon or how much the user has spent on ordering food in a specific time period. The main aim of this feature is to analyse and display the transaction information to the user in an interesting and comprehensible manner.

-

Banking

Fi not only provides all the services offered by regular banks, it constantly tries to enhance it. The online banking platform uses cutting-edge technology that plays a major role in carrying out beneficial data science research.

With the advantage of no physical branches or tiresome and lengthy paperwork, Fi’s engaging and easy-to-use interface design offers a never before seen banking experience.

-

Rewards

The reward structure is an effective way to create good savings habits. Earn rewards while saving money with Fi in the form of cashback or Fi coins that can be redeemed on major selected outlets, including Starbucks, Nike and Bigbasket.

-

Platforms

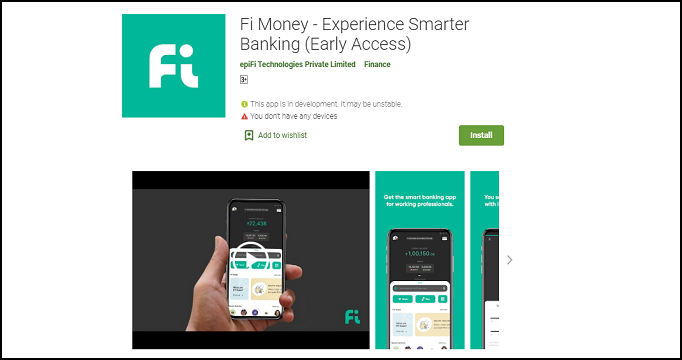

As Fi is still in the embryonic stage, apart from a soft launch, the platform is still undergoing the last few changes by conducting multiple experiments to refine all the features, making them perfect before successfully launching a full-fledged release. Moreover, users can avail of the early access feature and join the group as Fi releases. Currently, Fi is available on Android.

Fi Money Mobile App:

-

Android

Early access for android users is already available on the play store, and the users can be the first ones to try it and offer feedback on its functioning.

-

iOS

Currently at the final beta-testing stage and arriving at the app store soon, the Mobile iOS App by Fi will make certain of a swift and enjoyable banking experience. Also, early access users can register at “https://fi.money/waitlist” to get the latest updates.

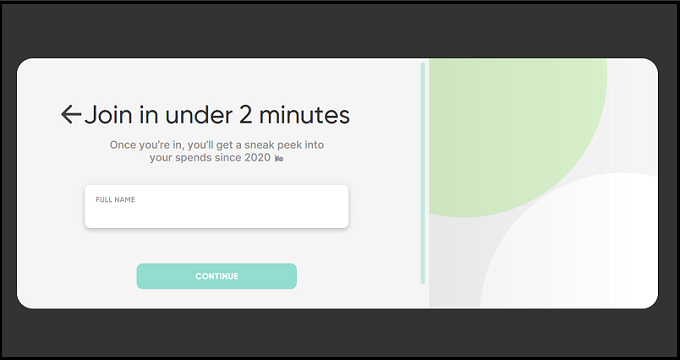

How to Sign Up For Early Access With FI Money

- Click on the “GET EARLY ACCESS” Button

- Type your full name in the box and click continue

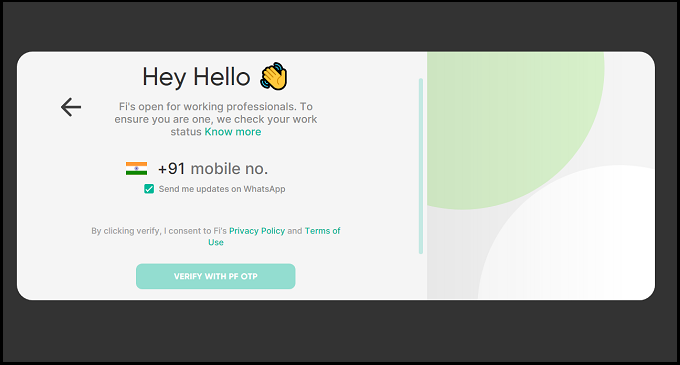

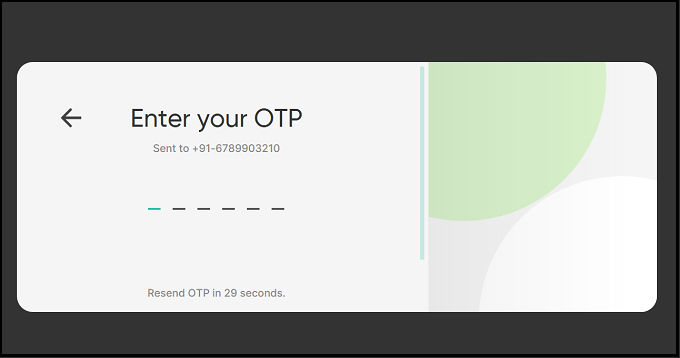

- Type the mobile number and click on verify with PF OTP. The user can also opt for WhatsApp updates by clicking on the tick box to get a quick way to keep in touch with the progress and updates.

- The OTP will be sent in a message on the mobile number mentioned. Open the message and enter the OTP here.

- After verifying your mobile number, it’s time to add the email id. This will allow the user to stay informed about the latest updates introduced by Fi.

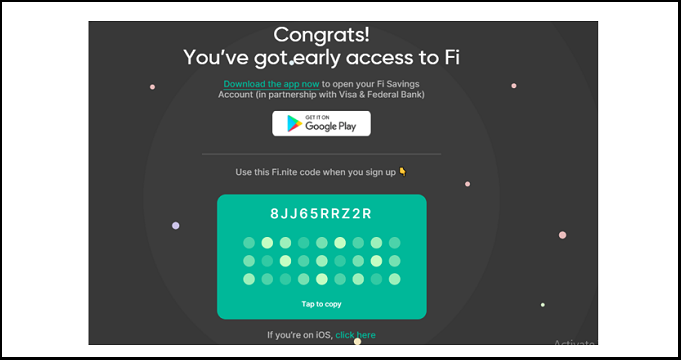

- Finally, the early access process is complete. Now the app can be downloaded on the mobile to access the open savings account. This page will also provide the Fi.nite code that will help you sign up with your phone.

- Open the app and click on “Sign-In”. Then type the registered mobile number used while making the account online. Another OTP will be sent on your mobile to confirm authenticity.

- After Logging in, there is the option for using a biometric authentication feature (fingerprint) to further safeguard your fund in the savings account. Also, for double security, the user needs to set a PIN, pattern or password before saving his fingerprint.

Remember, if the user forgets the pin, then after resetting it, the data will be erased to ensure maximum safety and reduce the risk of fraud.

- Follow the next few steps, type the Legal Name, email id. And at the end, the mobile app will automatically confirm the “Fi.nite” code mentioned above.

KYC

- After reading Fi’s Terms and Conditions, click on agree. And the app will take the user towards the quick KYC process. Type your PAN card details and date of birth. Note: if the user does not have a PAN card, then they won’t be able to open an account with Fi.

- After typing the PAN number, the app will ask for Father’s and Mother’s full names.

- Finally, use Aadhar details to complete the process. The user can upgrade the account further by doing a quick 3-minute video call for KYC to get additional features.

Money And Fee Structure

As per the guidelines by the RBI, savings accounts created via aadhar OTP cannot include deposits that exceed ₹ 1 lakh. To remove the limit of 1 lakh, a 3-minute video call is required with an agent from the federal bank on the Fi mobile app.

Fi Federal Account Fees

Fi is changing the standard banking infrastructure by waiving off traditional fees charged by conventional banks. Zero account maintenance charges, no hidden fees and no minimum balance fee make Fi a great banking platform. Though it is generally advisable to deposit at least ₹20,000 every month for saving or transaction purposes to enjoy Fi’s special features. Also, with 0 issuance fees, a free VISA Platinum Debit Card is given to all the users opening a Fi Savings Account.

Apart from features for domestic transactions, Fi even waives off charges on international transactions. Also, the Debit Card provided by Fi can be used anywhere where VISA is accepted. During withdrawal from an international ATM, a small fee of ₹100 is imposed on transactions, and ₹25 is charged for non-financial transactions such as getting a mini statement.

Using an ATM in India for withdrawal from a Federal Bank ATM is free, and at other ATMs, about 5 withdrawals are free of charges, and ₹20 is levied with the 6th, and following transactions carried out within a month. Losing your visa debit card costs a considerably small amount ₹250.

Payment Options

Payments are carried out via NEFT or RTGS Online. The transactions are free and quick to process.

Pros and Cons of FI.Money

Pros of FI.Money

- No need to stand in long bank lines or undergo tiresome paperwork.

- A new debit card is issued for free if the user loses the first one.

- Get two cheque books containing five cheques leaves for free at your doorstep every six months.

- Doorstep delivery of Proof of Funds documents for just ₹100.

Cons of FI.Money App

- Ios App soon about to be released

- Currently available on Mobile App Platform

Conclusion

Perfect for millennials, Fi Money App is a great online banking platform with compelling features and exciting offers. The ingenious dashboard and great user interface provide swift money-saving options and suggestions, making it easier for the user to make smart decisions.

The Fi app is a great personal assistant helping the user in numerous ways, including payment of bills to setting reminders for paying rent to even cancelling subscriptions.

![Best Cloud Storage For Photos For 2021 [Updated Top 5 List ]](https://www.appcraver.com/wp-content/uploads/2021/09/Best-Cloud-Storage-For-Photos-1.jpg)