Are you trying to find a detailed CoinDCX review? Well, then you have reached the perfect webpage. CoinDCX India is a prompt, hassle-free, and convenient platform made for trading in cryptocurrencies for people in India. The Coin DCX App is the largest crypto exchange in India, with over 150,000 users worldwide. A quick onboarding process, low trading fee, and a diverse collection of crypto-based services and products have made CoinDCX a popular platform for crypto investment.

This CoinDCX website review will take a close look at its features, pricing, registration process, pros and cons, and much more.

What Is CoinDCX? Is It The Best Crypto Exchange From India?

Launched near the end of the first quarter in 2018, CoinDCX is a well-known crypto exchange platform trusted by over 70M+ traders, major banks, and institutional investors. The CoinDCX platform offers a range of financial services as well as trading products that are safeguarded by layers of security to ensure secure transactions. The company is Indian ISO certified, provides high liquidity, and high return potential on your investments.

As of early October 2021, the CoinDCX website has generated over ₹75 billion in crypto sales and has over ₹3 billion-plus crypto invested, making it a popular crypto exchange. From spot trading to futures, CoinDCX is the one-stop-destination for traders looking to expand their crypto portfolio. Apart from the trading options, you can also earn passive income by referring to CoinDCX or staking your crypto.

Also read: GST Tax & Levy On NFTs May Hit Indian Non-Fungible Sales

Know All The CoinDCX Pros And Cons

Pros Of CoinDCX To Note:

- Quick verification and sign-up process

- A user can further enable other additional layers of security by the platform

- Users can start trading with a minimum of ₹100.

Cons Of CoinDCX Notable

- The platform should add other banks for the direct transfer of funds in the CoinDCX account.

- Customer support is not instant, and the user requires to fill a form to submit.

What are the CoinDCX Platform Features? Explained!

CoinDCX Margin Trade Platform.

Margin Trading by CoinDCX platform enables you to trade more crypto than you would usually do. CoinDCX Margin Trading offers up to 10x leverage on 250 plus cryptocurrencies, allowing you to yield better profits if done correctly. The platform provides you with a huge liquidity pool to multiply your profits by using active trading strategies.

There are 2 types of Margin positions known as Long and Short.

- In the long position, the funds are sold and bought by the trader at the Target Price. Traders opt for a Long position with the expectation that the prices will rise in the future.

- In the short position, the funds are sold and then purchased after some time. Traders opt for the short positions with the expectation that the prices will drop in the future.

Available Order Types :

- Limit: This is a limit order in which other elements like stop-loss price and target price are similar to the market order. Moreover, the leverage in the limit order can range between 1x to 4x.

- Market Margin Order: This is a market order with elements such as leverage, stop price as well as target price.

- Price: The price at which you want to enter or open a trade position.

- Target Price: The price at which you want to purchase, sell or close your order position.

- SL Price: This is the price at which you want to Stop Loss.

- Position Quantity: This is the quantity of cryptocurrency associated with the trade.

- Initial Margin: The starting price that an investor will have to pay with his collateral.

- Margin Taken: These are the funds lent to the trader by the exchange depending upon his collateral.

CoinDCX Spot Trading Platform

CoinDCX Spot is an easy-to-use platform where you can buy, sell, and trade in more than 250 cryptocurrencies. Spot provides a seamless as well as professional trading experience and can be controlled from a web browser. The CoinDCX spot platform also offers crypto exchanges with high liquidity for prompt execution of orders, opportunities for arbitrage, along with never-ending trading. Moreover, joining CoinDCX and starting with Spot trading is quick and can be completed in half an hour.

CoinDCX Futures Trading Platform.

Futures are contracts and a type of derivative that involves selling or purchasing assets at a pre-decided price in the future. You can use this to estimate and trade on future crypto prices without possessing the cryptocurrencies. Futures come with no cost of interest and provide more leverage as well as liquidity when compared to Margin Trading.

CoinDCX offers lucrative arbitrage opportunities and massive liquidity for maximizing your trading potential. The platform also allows instant order matching and helps a trader get orders passed in real-time. Moreover, CoinDCX offers various contracts to choose from including Perpetuals, Vanilla and, Inverse. Futures by the CoinDCX platform have better risk management along with low costs of transaction and come with a leverage of up to 15 times.

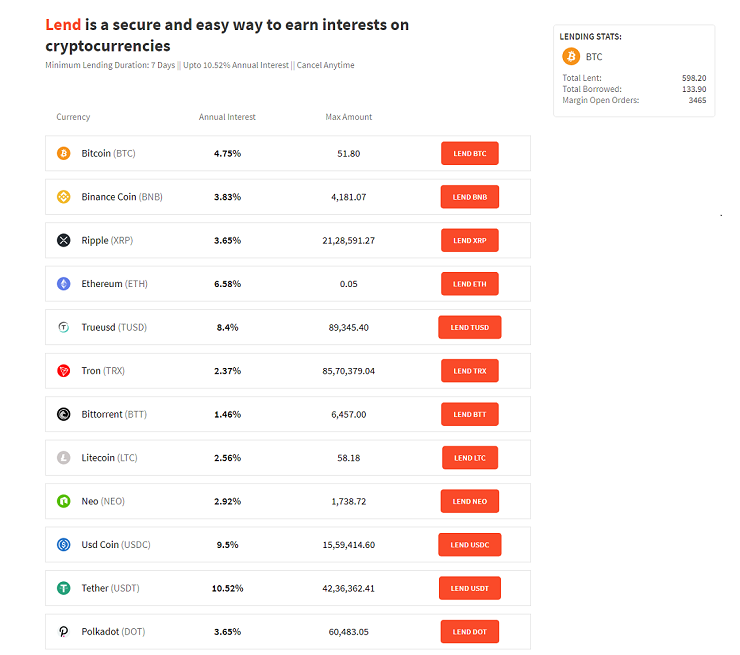

CoinDCX Lend Trading Platform.

Lend is a safe and reliable method for earning interest in different cryptocurrencies. The minimum duration for lending with CoinDCX is 7 days, and the traders can earn up to 16.25% annual interest, depending upon market demand and supply. CoinDCX provides an automated platform for lending where you can generate passive income on your crypto.

Moreover, your funds are safeguarded by BitGo’s insurance policy and MultiSig Cold wallets. Also, with CoinDCX, there is no transaction fee involved while depositing or withdrawing the funds, and there is no need for KYC done for lending crypto until you are going to withdraw above 4 BTC or dealing in fiat. Furthermore, you can also choose to withdraw your CoinDCX funds prior to the finish of the lock-in period, but will receive no interest for it.

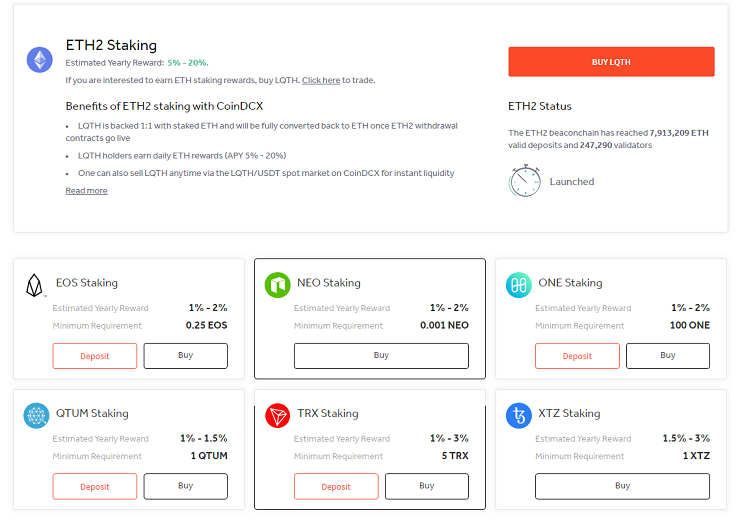

Know All About CoinDCX Stake Platform!

Staking is a profitable method for earning rewards on cryptocurrencies laying ideal in the wallets. CoinDCX Staking makes certain that you don’t need to give up liquidity while getting rewards on your crypto. Moreover, there is no lock-up period, and you can withdraw or sell your crypto anytime you want without any penalties.

For staking with CoinDCX, you will have to be registered as well as become a verified user with a minimum balance for the particular cryptocurrency. Also, the users can choose to buy cryptocurrencies from the CoinDCX crypto trading platform or transfer them from their wallets.

The CoinDCX website recommends maintaining the balances for a minimum of 24 hours for receiving rewards. During the 24 hour window, the CoinDCX platform will take snapshots and assign the rewards for Staking based on them. CoinDCX App also provides the option for sub-accounts Staking that works like a normal account. You just need to have individual wallets for each sub-account and should deposit PoS tokens in the wallets.

The platform also has a fixed method for calculating Staking rewards on your cryptocurrencies:

- Stake generated daily by each user = CoinDCX Daily total stake * asset holding ratio of the User token.

Who are The Founders Of CoinDCX? Know All About Sumit Gupta and Neeraj Khandelwal

Currently completing his graduation as well as PG from IIT Bombay, Sumit Gupta is the CEO and co-founder of CoinDCX. After joining an MNC located in Tokyo, Sumit helped in inventing a location-based online marketplace in India that quickly became a multimillion-dollar startup. He believes educating people about crypto and introducing new cryptocurrency products can make this industry bigger in India.

Another co-founder, Neeraj Khandelwal, is a skilled engineer and the CTO of CoinDCX. Graduated from IIT Bombay, Neeraj believes Blockchain along with AI can transform the way the world works. His technical leadership is helping DCX spread across the world and making easy-to-use crypto instruments available to all.

How To Open Account With CoinDCX App From India?

Step 1: Head to the CoinDCX India website’s homepage with your mobile browser and choose between IOS or Android devices.

Step 2: You will be then redirected to the Indian Play store, click on install to download the CoinDCX App.

Step 3: Open the CoinDCX App after downloading it and click “Signup with email.”

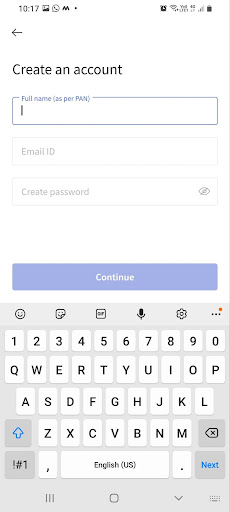

Step 4: Fill in the details. Also, the full name should be the same as PANCard details issued by the Indian Government.

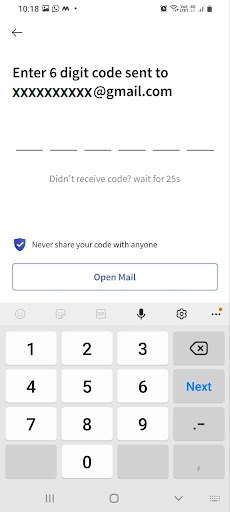

Step 5: A verification 6 digit code will then be sent to your email. Type the same in the box.

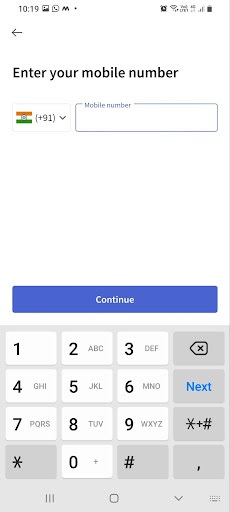

Step 6: Next, fill in your mobile number and an OTP will be sent on it.

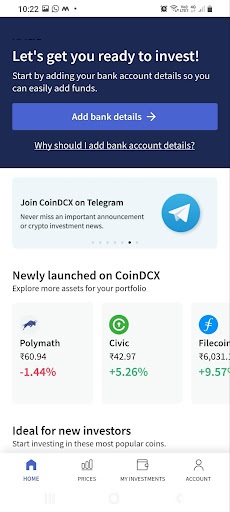

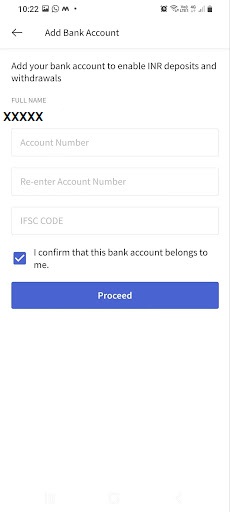

Step 7: The CoinDCX registration is now complete. To start trading, first, you need to add Indian bank details for deposits and withdrawals. Click on Add Bank Details.

Step 8: Add the name, and account number along with the IFSC code for Indian Banks.

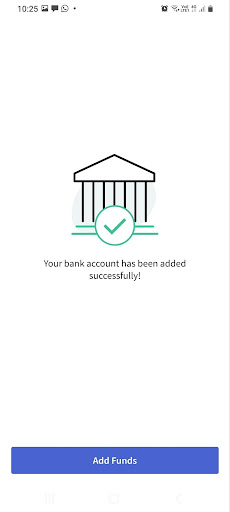

Step 9: After a quick verification, the account is now added. Click “Add Funds”

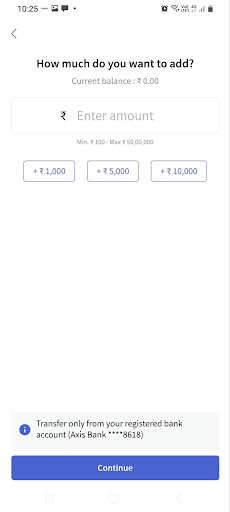

Step 10: Next add the amount you want to transfer to your CoinDCX account. The Minimum amount is ₹100 to ₹50,00,000 (Indian Rupees). For the first time, simply add ₹100 for confirmation.

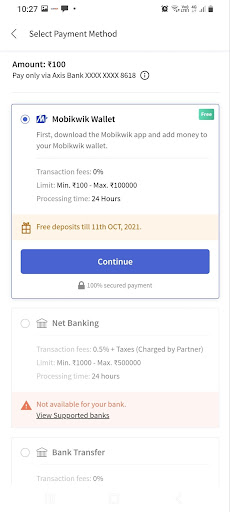

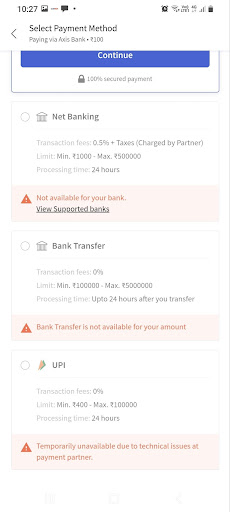

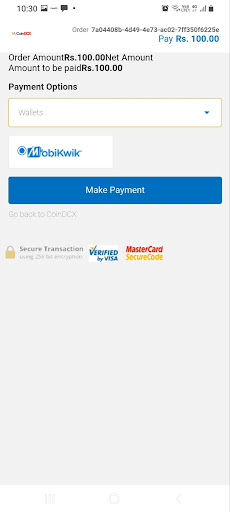

Step 11: Next, select the method you want to transfer. Currently, Mobikwik is the most preferred option for funds transfer in CoinDCX India. Also, depending upon your transfer amount and the bank account, only limited transfer options will be available.

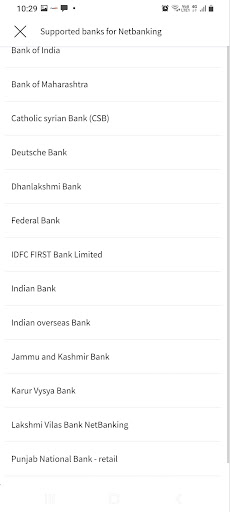

Also, not all the transfer methods are available depending upon your bank account. Here is the list of Indian banks the CoinDCX platform currently supports for its customers

If you want to use Mobikwik then download the app on the play store. Make an account on it, transfer funds from the bank, and then type your Mobikwik account number in the CoinDCX app to link them.

Coin DCX Deposit Options for Indians :

How To Transfer INR Into CoinDCX And Minimum Deposits Explained.

- Mobikwik wallet: Mobikwik is a mobile app used for recharge to bill payments for Indians. You can use Mobikwik to securely transfer funds if transferring a small amount or your Bank account is not supported by the CoinDCX platform. Mobikwik Limit is ₹100 to ₹1,00,000 with a processing time of 24 hours.

- Net banking: Transaction fee of 0.5% plus taxes and the minimum amount you can transfer is ₹1,000 to a maximum of ₹5,00,000 with a processing time of 24 hours.

- Indian Bank transfer: The minimum amount transfer is ₹1,00,000 to a maximum of ₹50,00,000 with a processing time of 24 hours.

- UPI India: The minimum amount transfer is ₹400 to a maximum of ₹1,00,000 Indian rupees with a processing time of 24 hours.

How to withdraw Funds From CoinDCX India?

Visit the homepage of the Indian version of the CoinDCX App, click on Funds then choose withdraw in the drop-down menu. Then select the rupee symbol on the page. Fill in the amount you want to withdraw and click verify.

CoinDCX Fees for Indian Customers.

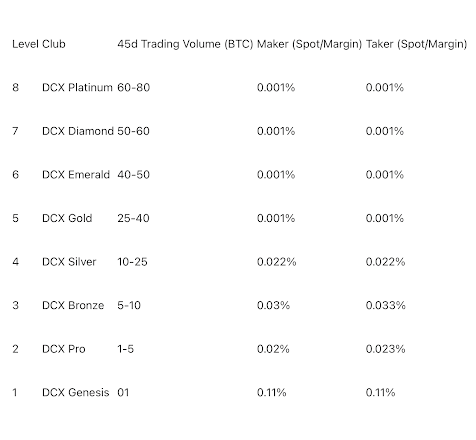

Users of CoinDCX India are part of the 10 different DCXClub levels. Your club level is based on the last 45 days’ trade volume on Margin and Spot. Depending upon your club level you with be charged with the transaction fee:

You can also visit this link to explore the entire fee structure of CoinDCX ranging from withdrawals to margin. Also, CoinDCX charges no charge fees on deposits.

CoinDCX KYC- Know How To Verify Your Identity from India.

List the verification steps and all types of documents required for verifying an account in India.

Step 1: To complete KYC click on your avatar on the CoinDCX homepage and select Profile

Step 2: Then select Complete KYC

Step 3: Next step is to verify your identity. Submit your identity card. You can use the phone camera or upload images on a desktop browser.

Step 4: You need to click a selfie after uploading the pictures of the front and backside of your identity card.

Step 5: Verify/Upload your Indian tax ID card for the last step.

Step 6: Finally your verification process will start.

CoinDCX Customer Support

To contact CoinDCX customer support in India, click the Headphones icon on the homepage and select Submit an Issue in the drop-down. On the next page, select Submit a Request. Fill in the details and click submit.

Also, read our WazirX App Review – which is the main competitor for CoinDCX!

Is CoinDCX App Safe For Indian Customers?

Here are some of the steps taken by CoinDCX India to protect the data and funds of the user:

Cold Wallets gets Geographically Distributed

This means no individual can access different wallets at the same time or withdraw funds from any wallet.

Regular Stress Testing

CoinDCX platform performs regular tests on their system to make it withstand a heavy workload and detect any signs of intrusion.

2-Factor Authentication

CoinDCX App has a 2FA that adds an extra layer of safety to an account. You can enable the Google Authenticator or get OTPs received on the registered mobile number.

Vetting of Accounts

The security team of CoinDCX vets withdrawals and works on different account reconciliation to ensure the utmost safety of funds.

Complete Fund Safety

About 5% of the total funds get stored in the hot wallets. Moreover, 95% of funds are put in multi-sig cold wallets. Also, CoinDCX App keeps full reserves for facilitating quick withdrawals.

BitGo Insurance

The funds in CoinDCX are shielded by the USD 100 million insurance policy by BitGo. It further improves safety and provides a confident reading experience.

CoinDCX Has Also Taken Multiple Actions To Further Safeguard The Funds Of Users After Hearing About Cashaa:

- Increased fund surveillance: CoinDCX crypto app has improved the surveillance of all the transferred funds and will flag any issue.

- Forensic tools: CoinDCX App has integrated excellent forensic tools used globally for tracing all funds related to fraudulent activities

- Tracing wallet: The security team of CoinDCX verifies the wallet addresses and checks for any issue with the primary address along with the recipient’s addresses.

- Blocking Funds: CoinDCX also blocked funds linked to the primary address along with the recipient’s addresses.

Moreover, CoinDCX Recommends Using The Following Guidelines For Further Protecting Your Account.

- Set up 2 – Factor Authentication (2FA)

- Always double-check the browser address bar to ensure you are on the official website.

- Never share your sensitive information with anyone. Also, a CoinDCX employee will only ask for the phone number, email, or your Support Ticket ID.

- Set up a strong password

- Always cross-check the address of the recipient

- Beware of emails sent by scammers asking for login details

You can click on your avatar and select security to set up all the additional security.

CoinDCX Review Conclusion

Nowadays, if someone wants to know if a system is worthy of time or not, taking a look at its reviews has become a common action. Reviews do not lie. Consumers do not hold back. They say it like it is to warn others of their positive, neutral, or negative experiences. Fortunately, for the CoinDCX, positive reviews keep pouring in for it every day. People are content with the results they are acquiring and are sharing this fact with the rest of the world.

Backed by multinational investors, CoinDCX crypto exchange is a well-known crypto exchange platform designed for investing as well as growing your crypto portfolio. CoinDCX India has a user-friendly mobile app perfect for beginners as well as experts. The website also provides courses on blockchain and crypto by leading experts to educate newcomers about the product. CoinDCX takes strict measures to safeguard funds, contains an easy sign-up process, and anyone can start trading for as low as ₹100. Investing with CoinDCX can yield higher profits and make your crypto trading lucrative.

CoinDCX FAQ: Notable Queries

Q: Is CoinDCX Bitcoin Exchange Legal in India?

Yes, it is. Recently, the Supreme Court judgment was ruled in support of the crypto investors in India, making CoinDCX Bitcoin Exchange legal.

Q: What are the different products offered by CoinDCX India?

A: CoinDCX India offers

- Insta

- Lend

- Spot Trade

- Margin Trade

- Futures

- API Docs

- Markets

- Stake

Q: Does CoinDCX have a referral bonus?

Yes, you can refer and earn around $25 for every CoinDCX referral who has transferred funds over 5 BTC. Click here to know more about referrals.

Disclaimer: Cryptocurrency trading is subject to market, regulatory, as well as technical risks. The prices of crypto depend upon the demand and supply in the market.